When considering whether you can afford to invest enough money to retire early, you’re bound to ask if doing so is possible when you have debts to pay off. Add in the conventional wisdom that incurring debt is bad and that debts should be cleared before saving or investing income, and you’ve really got quite the quandary.

So let me pose a question, and discuss its answer below.

Question: Can you strive toward FIRE or retirement when you have or may incur debt?

Answer: Yes, depending on the debt.

Not to pose another question, but did you really think it would be a single word answer? In this post, I’ll discuss debts generally, and in subsequent posts will talk in more detail about specific types of debts, including student-loan, credit card, home mortgage, cars, and investment.

Let’s start with the fundamentals. A debt is an obligation owed to another, simple as that. It may be money, property, or something else, but if you’re in debt to someone, you owe them something, and hopefully it was in exchange for something that person gave to you. Of course, the kind of debt in which we’re interested is financial debt; that is, when you owe money presumably for money or property that had previously been provided to you on credit. You may be making payments toward re-paying the debt or you may have a lump-sum payment coming at the end of a specified time period.

Because money or property loaned is never done so for free, the aspect of debt in which we’re most interested is interest, which is the “cost” of borrowing. Two common terms that you may hear associated with debt are principal and interest. Principal is the money you’re actually returning back to the lender, whereas interest is the upcharge for the lender having given you that money in the first place. If you take out a loan for $500,000 to buy a house, the amount of the loan given to you – $500,000 – is the principal. Interest is the cost of borrowing, expressed as a percentage, say 5%. Each month you’ll make a payment to the lender, which will consist of some principal and some interest (typically), and those payments will continue until the principal is repaid in full.

The amount of interest you’ll pay over the life of the loan depends on the term. So, for example, if your $500,000 loan has a term of 30 years, at the end of the 30 years, you’ll have paid a total of approximately $966,000, which consists of returning the $500,000 in principal, plus $466,000 in interest. The same concepts apply to most common debts faced by your average consumer – you and me. At the beginning of the term, you’ll typically pay more interest, and as the principal amount starts to be paid down, the outstanding interest decreases, and each payment will include more principal. The calculation of how much interest and principal you pay in each payment period over the life of the debt is called amortization.

Taking that same example, if your loan term is 15 years, after 15 years you’ll have paid a total of $711,000. You’ll pay less interest overall, but each payment will be higher than if you spread the loan out over a longer period. If you want to see how much of each payment is principal and how much is interest, look up “amortization” schedule or table or something similar.

Understanding how much interest you pay over the term of a loan is important to figuring out how you can invest money toward retirement even if you have debt to pay. But before I get into this, let me start by saying that there is a HUGE psychological factor at play here. Don’t read the words here and think, oh well, the calculations might play out, so this is the right course of action. NO – take into account how debt affects you. Even when you can afford to pay it down, the very presence of an obligation might be enough to persuade you to pay your debts off first before starting to stash your extra cash for an early retirement. Keep this in mind.

However, and this is a big however – if you want to have any hope of retiring, let alone early, you should do whatever is in your power to start saving in a 401(k) or IRA as young as you can if those options are available to you – assuming that your debt is not supremely high-interest like credit card debt. The compounding returns will often make up for it down the road. Plus with the most difficult part of savings being that first step, it’s better to start as soon as you can. If you have a 401(k) match, at least save enough to take advantage of it, and then you can catch up later with additional savings.

That out of the way, let’s talk about how this pans out. Early in your career, your most likely debts might be student loan, a car payment if you don’t live in New York City, and possibly some credit card debt. Of those three, and really of any debt other than loan shark debt, credit cards are the worst to carry. They have extremely high interest rates, meaning there is very little chance that you can earn more on the money in the market instead of paying down the credit card balances. You might even consider paying down credit card debt before even allowing money to be deferred into a 401(k). If you let credit card debt accrue, you’ll never pay it off. Perhaps equally as bad, it’ll lower your credit score, leading to higher costs of borrowing on everything else.

So how can you determine whether it’s worth it to pay down a debt versus save for retirement or otherwise invest. It boils down to what the debt costs you compared to what you can earn on that money. Let’s try some examples.

Example 1 – Student Loan Debt

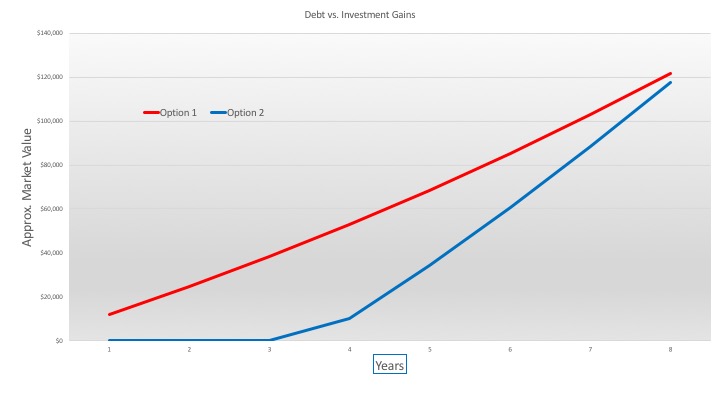

At the end of each month, you wind up with $2,000 in cash that you don’t need to pay your day to day expenses. Say you have $80,000 of student loans remaining with a 5% annual interest rate, and 8 years left on the loan term. Your monthly payment is $1,000. What do you do with that $2,000 per month?

Option 1: pay $1,000 per month in student loans and invest the rest.

Option 2: put all $2,000 per month on the student loans to pay them off early.

How does each option play out?

Option 1: When you make only the monthly payment of $1,000 on the loan, after the remaining 8 years, you’ll have paid approximately $96,000 in principal and interest. But, you’ll have invested $1,000 per month for 8 years. Assuming a 6% return, your investments should be worth about $118,000 – $122,000, consisting of $96,000 of principal invested and $22,000 – $26,000 in gains. I note the difference between invested principal and gains to illustrate that even after accounting for the taxes on gains (15% if using the long-term capital gains rate against $22k – $26k in gains = $3,300 – $3,900 in taxes), you’d still end up ahead.

Option 2: Paying $2,000 per month, you pay off the loan in about 3 years and seven months, paying a total of $88,000 in principal and interest. Then, for 4 years and 5 months, you’ll have invested $2,000 per month, which, assuming a 6% return, nets a total at the end of 8 years of approximately $115,150 – $120,150. This consists of $106,000 of principal and $9,150 – $14,150 of gain.

In these scenarios, the results are about the same, mostly owing to the fact that the interest rate on the loan is about the same as the assumed rate of return on investment. But, there are some caveats, especially in scenario 2. The 6% assumed rate of return in the market might not be realistic over such a short time frame – a dip or an upswing in one of those years might not even out, drastically altering the results. But in the end, you do see how investing for longer results in a larger market value at the end of the time period, even though you also paid more interest on the loan.

Example 2 – 30 Year Mortgage

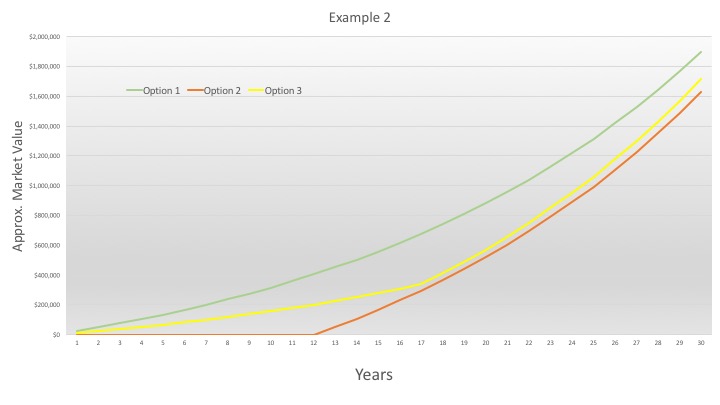

Let’s look at a different example where there is some divergence between the interest rate and rate of return and where the assumptions might be a little more realistic – a home mortgage. Assume a $500,000 mortgage with a 30 year term and a 4% interest rate. Each month you have a minimum monthly payment of $2,387. Assume further that after all other expenses, you wind up with an extra $2,000 per month that you could either invest or use to pay down the mortgage, setting up three options:

Option 1: Pay $2,387 per month on the mortgage and invest the other $2,000 per month for the term of the loan.

Option 2: Use the $2,000 per month to pay the loan off early, then after the loan is paid off, invest the $2,000 per month, plus the $2,387 per month that you were paying on the mortgage.

Option 3: Use $1,000 per month to pay the loan early, invest the other $1,000 per month. Once the loan is paid off, use the $2,387 to invest plus continue investing the additional $2,000 per month.

How does each work out, in each case assuming a 6% average rate of return on investment (which is more realistic over 30 years):

Option 1: You’ll end up paying a total of $860,000 on the loan. In your brokerage account, you’ll have approximately $1,900,000.

Option 2: You’ll end up paying a total of $630,000 on the loan, with the loan paid off in 12 years. After 18 years of investing a total of $4,387 per month, you’ll have about $1,627,000 in your brokerage account.

Option 3: You’ll end up paying a total of $690,000 on the loan, but the loan will be paid off in 17 years. After investing $1,000 per month for 17 years and $4,387 per month for 13 years, you’ll have approximately $1,716,000 in your brokerage account.

The results are mixed here, but you see fairly clearly that Option 1 nets the highest return. Instead of using money you pay down a 4% obligation, you’re investing money and gaining 6% on it. Of course I have to mention that these calculations are highly approximate. There’s so many variables to keep in mind like the fact that interest payments on a loan may reduce your taxes, while keeping an investment account may increase your taxes. It may also be unreasonable to assume that your income will permit you the same contribution every month for 30 years. Also keep in mind for options 2 and 3 that due to the shorter investment term, the assumed net average return of 6% is likely to be much more variable.

If nothing else, the above is a good ballpark to compare investing against paying a debt. The other consideration, and one that’s important to consider, is liquidity. Choosing option 1 in both examples above leaves you with a larger amount of liquid assets over the duration of the term, meaning that you have quicker access to cash on hand in an emergency. And, in some respects, particularly in the mortgage example, you’ve also achieved greater diversification – as in, you’re investing the $2,000 in capital assets and the mortgage payment into real estate. If you were to choose Option 2 in the mortgage example, those first 12 years are essentially putting all your investment eggs into a single asset: your house. Options 1 and 3 allow you to spread risk.

Discussion of Options

So what’s the conclusion of everything I said above? Should you always invest money when you think you can get a higher return than the amount you’d otherwise pay in interest on a debt? Not necessarily. In some cases the decision is easy. If you’re facing credit card interest of 20-30%, it’s a no brainer to pay that off before you start attempting to reap gains of approximately 6%. But when facing a spread 4% vs. 6% returns, the math is a little different.

I suppose what I’m saying is that the common wisdom of eliminating debt before doing anything else with your money is not always accurate. Assuming you can overcome the mental aspect of being indebted, it may not always benefit you to clear your debts before investing – there are certainly situations where it makes sense to invest what you can while making your debt payments. But, like everything, it’s up to you and your tolerance for risk. Investing money is obviously more risky than using it to pay down a debt. In the mortgage example, if your return only ends up being 3%, you’ll have lost money by keeping a loan with a 4% interest rate alive for longer.

If we need a conclusion, here it is: take the debt variable into account. You may be able to do better in the long-term through a combination of investing and paying off the debt than waiting until the debt is eliminated before investing.