If you’re already investing, you’ll know what I mean, and if you haven’t yet, you’re bound to face a bout of the mental contortionism I’m about to describe.

You’ve transferred money to your brokerage account, found a stock you want to buy, executed the transaction, then witnessed the shares show up in your portfolio. Ten minutes later, it creeps down, then more, then closes the day several points down from where you bought it. Or, and perhaps worse, it goes down, down, down, then back up to right around where you bought it. Sure, you ended up even, but if only you’d waited an hour, you could have bought those same shares for a much lower price. Ooops. If you’d timed the market right, you could have captured those gains.

Or maybe you’ve talked yourself into falling for one of these other scenarios. The market is headed up, and up, and up. Meanwhile, you’re putting cash into your account thinking, well at some point in the future it’ll cool off a bit, and when it does, then I’ll buy some shares – right now they’re overvalued. But it doesn’t. A few weeks go by, and it still goes up. Looks like you missed out on some gains. Then, FOMO coursing through your blood, you buy, and then, guess what, here comes the cooling off.

One more, because it hurts so good. The market is headed down. So you let your cash sit idle, thinking you won’t go down with the sinking ship. Plus, you say, you’ll know when it’s going to pick back up, and you can buy when prices are even lower than they are now. One day the market starts to creep back up, and you think, this is just an aberration, I’ll keep waiting. But then it goes up, and up again, and before you know it, you’ve missed out on buying at the bottom.

In each of these heart wrenching situations, it seems that what you’re thinking about is “timing” the market. As in, you were thinking there was or would be a perfect time to execute your transaction. It falls right in line with your theory of buy low and sell high – after all, isn’t that how anyone makes money in the stock market?

It’s also the perfect trap. Some of us have surely fallen victim to it. And if you haven’t, you may have still thought about it. So let’s talk about it a little more and address how trying to time the market adds a significant element of risk that most long-term investors have little reason to take on.

Let’s start with an honest truth, one that makes this so tempting: if you do “time” the market correctly, you’ll do well. But what makes you think that you can “time” the market? Let’s look at a scenario from 2020, when the COVID-19 pandemic temporarily destroyed the US stock markets. Here’s a graph showing the Dow from January through November of 2020:

Looking back, it’s easy to see a number of great spots where timing the market would have worked out in your favor. If you’d sold off in late January or mid-February before the market dipped, and then repurchased just before April as the market hit the floor, come September when the Dow had fully recovered, you’d have done quite well for yourself.

So you say, “if only I had….” But you have to stop right there because the scenario you’re about to posit is far from realistic. It’s easy to see what happened in retrospect, but think about what was happening at the time. Was there ever a moment in January 2020 when you had the sudden realization that the stock market would soon fall quicker and just about as far as it’s ever fallen? Was there ever a moment when you thought: “well, I’m taking a long-term approach to investing, but, something’s about to change in a big way, I should cash out for now.”

Even when the market started to fall in February and into March, was there ever a moment when you thought, “it’s got so much further to go that if I sell everything now and then buy back in at the dip, I’ll make a ton.” (Not to say that it doesn’t go through our minds to sell off when things look bad to preserve what we have, even though common wisdom tells us not to). Most likely you thought there was no way the market would end up going down as far as it did, or that you’d just stick it out and in the long-run it would come back.

As the market hit its lowest, there was a fantastic buying opportunity. It’s easy to look back now and see it, but did you take advantage of it as much as you could at the time? Aside from the fact that most people don’t sit on a pile of cash waiting for a moment like this to buy, your average investor was probably a little spooked after the market had lost about 30% of its value. Think back to late March 2020 and try to remember if you thought: “ok, the carnage is over, now’s the time to start putting more money into the market….” I’m thinking there was some apprehension at the time – there certainly was for me.

This is an interesting scenario. I’m not saying that there weren’t people who did make out well when the market went for a ride in 2020. There’s always some cadre of people who manage to time the market just right – and those are the people who get the press. What you generally don’t hear about are the 99.9% who don’t properly time the market or don’t do anything at all.

But look at what happened in the end. If you did nothing but your regular investing routine throughout 2020 – as in, you didn’t try to “time” anything, the market value of the average portfolio not only returned, but ended up higher at the end of the year. There was, no doubt, a dip in the middle, and your stomach probably did some spinning in those months as you watched the market dive, but once again a longer-term outlook prevailed.

The way the market moved in 2020 is an extreme example of how timing the market can be risky. What if, for example, when the Dow was at 20,000, you thought it might go down to 10,000 and you sold off. You might have sold off a great deal of accumulated gains or perhaps taken a significant loss. Or what if you held on to the cash even as the market started coming back up, as you sat and thought it was due for another dip. Next thing you know the Dow is at 25,000 and you decide you better start buying back in. If you did this, you would have sold low and bought high – not exactly the way to increase market value.

There’s any number of permutations of how you could have tried to time the market in 2020, and, by and large, unless you executed them at the exact right time, most of them would leave you less well off than if you did nothing and let the market bounce back, as it eventually did.

The same could be said of your more routine investing. It’s an unfortunate pitfall of human nature to think you could have done something different if you take $1,000 of your paycheck and buy shares that later dip to a lower price as the trading day progresses. But think of it this way: how could you have possibly foreseen it would do that, particularly if you’re a working FIRE investor who doesn’t spend your entire day trying to determine how the market is going to move.

Let’s be realistic: as you sit, right now, can you tell me what the market’s going to do tomorrow, or next week? If tomorrow the market skyrockets and in two days you’re thinking, “if only I’d…” – NO! Think back to this moment when you had no idea and remind yourself there’s really nothing you could have done differently.

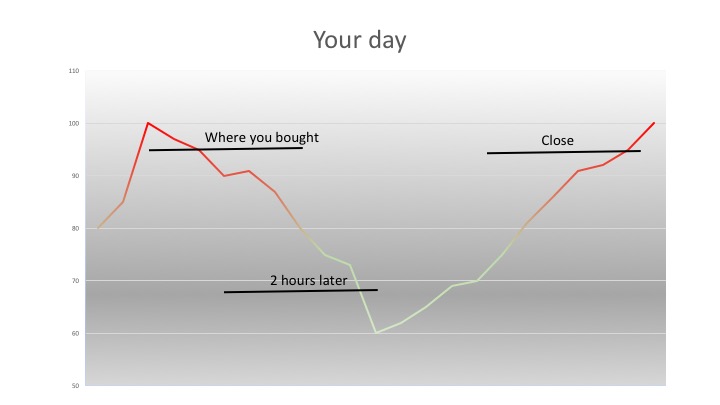

And, remember, if you’re trying to save for retirement, the goal is not to squeeze an extra $8 gain in the day you purchase shares of stock. Your goal is to purchase assets and watch them grow over the longer-term. There are peaks and dips on the chart as you head in that direction – that’s inevitable, as growth and loss are rarely linear. It’s not about where the shares you purchased at 9:30 a.m. are at 2:00 p.m. the same day, or even a year later, it’s about where they are 10 to 15 to 20 years later. And, while nothing is guaranteed, history has shown us that stocks tend to increase in value in the long-run.

Remember too that in the long-run, those little peaks and dips will tend to offset each other anyway. It’s easy to harp on when you purchased a share that sunk over the trading day, but there will be times (most likely) when you purchase shares that go up later in the day – we tend not to fixate on those – and nor should you, because again, it’s where it is years later that matters.

What’s the takeaway here? It’s that trying to “time” the market can be very risky for the casual investor. There are people who do it – day traders make a career out of market timing by watching for signals indicative of how an asset will move – but for a long-term investor saving for retirement, you’re likely better off keeping a long-term horizon and not attempting to time your investing to eke out marginal short-term gains.

Like anything though, use your common sense. If there are huge red flags, don’t ignore them. But generally, remember why you’re investing in the first place: for long-term growth that will allow you to retire. If you play it too risky, you may not capture the market’s long-term upward trends, making it more difficult to get to where you need to be. And remember this: it’s impossible to predict the future, but simple to look back and think you missed out, so don’t spend time needlessly dwelling on what could have been.