You might be surprised to learn that back in the 1970s and 80s, it was not uncommon for banks to offer over 10% interest on a standard savings account. If you look at the current interest rates that your standard savings account offers, it’s hard to believe just how much interest savings accounts used to fetch. It might explain why, after so many years, we’re still somewhat beholden to stashing at least a portion of our money in a savings account with our bank of choice.

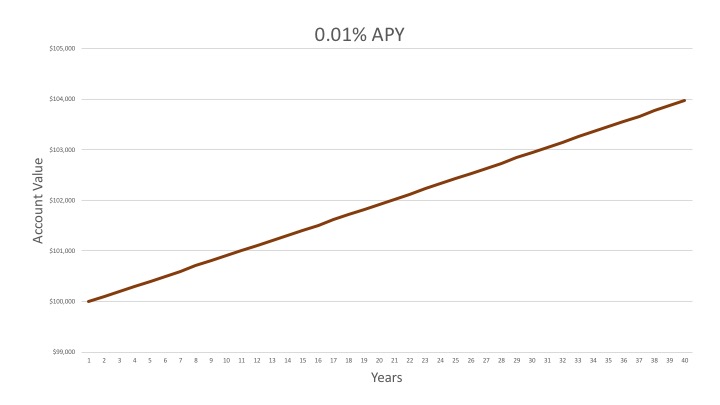

Nowadays, your average bank probably offers somewhere in the ballpark of 0.05% to 0.1% annual interest on a savings account. If you look it up, you’ll run into the acronym APY, which stands for average percentage yield. For a quick calculation, if you have $100,000 in a savings account, at a 0.05% APY, you’ll earn $50 per year, and at 0.1%, a grand total of $100.

Does that hardly seem worth it to you, because it definitely doesn’t to me. And really, it’s not – there are plenty of better things to do with your money than stick it in a savings account.

But, of course, one thing we always want to keep in mind is whether it’s wise to have a rainy day fund. And if you decide that it fits into your plan to keep some cash safe from the risk of the market and covered by FDIC insurance, your first thought might be just to leave it in the relative security of a savings account.

Before you do that, understand that there are options for your money that might be more beneficial than the savings account offered by your local bank.

An option you may consider is a high-yield savings account, which are savings accounts that offer significantly higher APYs than traditional retail banks. They’re easy to find through a simple online search and there are plenty to go around. As you search, you’ll see that most of them are online banks only, meaning they don’t have traditional branches where you can walk in and deposit a check. Instead, you either have to deposit cash by EFT from a traditional bank, or deposit your checks through an online App, where available. The online presence of these banks means that they won’t have their own ATMs either, so take that into consideration when determining how and when you might need access to funds.

High-yield savings accounts are a decent option to keep an emergency fund and earn a least a little more interest than at a traditional bank. But remember, the interest rates will still fall well short of traditional market returns. The upside of course is that there’s little risk in holding money in a savings account, especially with FDIC insurance. So if you’re inclined to let your money sit, a high-yield savings account is a decent place to do it.

Another option is leaving cash uninvested in your brokerage account. When you register for a brokerage account, it’ll typically ask you what you want to do with uninvested cash, and the default is usually that the cash is held in some type of money market fund. These funds traditionally pay returns that approach the prevailing interest rates of high-yield savings accounts. At a minimum, they’re much higher than a traditional savings account at your neighborhood bank.

What you have to make sure of before committing your pile of cash uninvested in a brokerage account is the protection it gets if the firm fails. Because the cash is technically “invested” in a money market fund or something of that nature, it may not be eligible for FDIC insurance. However, it may still be eligible for SIPC coverage. And, some brokerage firms will “sweep” the funds each day into an account that is eligible for FDIC insurance. So there are several ways they can make it happen – you just need to verify how your cash is protected as part of your due diligence. If you can’t understand the explanation on the website, or it’s not clearly written, this might be one time to place a call and hear it from an actual human.

The large brokerage firms also offer some of the services that banks offer too, including high-yield savings accounts, and accounts that allow you to write checks and use a debit card, if you’re so inclined. These are definitely worth looking into as alternatives for your money. Just remember to look out for a few things:

- Interest rate (APY)

- How money is deposited

- Ease of withdrawing or transferring money

- FDIC or SIPC protection

If you find something that checks all the right boxes, you’ve found your place. Now remember to make sure you’re holding only the minimum amount of cash you deem prudent to protect yourself in the event of a market downturn or some other adverse life event. Holding too much money in cash will eat into your long-term returns, ultimately impacting the ability to invest your way to early retirement. FIRE is not something that happens with returns less than 1%, but it never hurts to set a little money aside in a safe place…just in case.