You may have noticed that anytime the Chairman of the Federal Reserve Bank speaks, it tends to make news. And for good reason, the Chairman of the “Fed” (as it’s known if you’re into the lingo) is the ranking decision maker and public facing representative of one the most powerful institutions in the world, and the actions that the Fed takes can have a significant impact on financial markets. So let’s talk about why this matters to you, and how this impacts a FIRE investor.

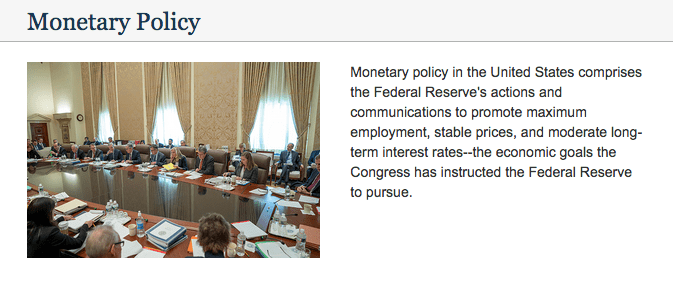

Naturally, I won’t get into the gory details. Suffice it to say that while the Fed has numerous responsibilities, the one you probably care about the most is that the Fed controls monetary policy in the US. And indeed, that’s the portion that makes its way into the news.

“Monetary policy?” you say, “sounds interesting…”

Let me fill you in – it is. Monetary policy essentially means control over the prevailing interest rates – you know, the charge for borrowing money. The cost of borrowing has an extreme influence over the economy as a whole, and can impact such aspects of the economy as mortgage lending and the stock market.

Before getting into that, some background on the Fed’s structure. The Fed is not just the single person you might see on tv talking about interest rates and liquidity; it’s actually a fairly dispersed system that takes input from throughout the country. The primary body in charge of the Fed is its Board of Governors, which is comprised of seven members, each of whom is appointed by the president and confirmed by the senate. Also comprising the “Fed” are the 12 regional federal reserve banks scattered about the country, the largest purpose of which is the regulation of commercial banks.

Among the various further breakdowns of the Fed, the most relevant to discuss is the Federal Open Market Committee (FOMC), which votes on and sets monetary policy. The FOMC is made up of the seven members of the board of governors and 5 of the 12 presidents of the regional federal reserve banks. One of those 5 seats is reserved for the president of the New York fed and the other 4 rotate. The FOMC meets four times each year, something you might notice as interest rates are discussed on a quarterly basis. And essentially what they do is determine whether to keep interest rates as is or implement a change.

The primary component of the Fed’s control over interest rates is the federal funds rate. This is the rate that banks charge themselves for overnight loans. I could go on for pages explaining why banks loan each other money every night, but let’s put it short and sweet: the Fed (as one of its other duties) requires banks to hold a certain amount of cash in reserve, and to meet it every day, banks loan money among themselves as each one balances its reserves to comply with Fed requirements.

Let’s talk for a second about the mechanics of monetary policy. The Fed does not just proclaim a federal funds rate; rather, the Fed sets a target for the rate that it achieves through a variety of mechanisms. Again, the details of these are inconsequential to this post, and there’s plenty of sources out there if you want to learn more. But basically, the Fed works to achieve a target federal funds rate by either buying or selling bonds on the open market.

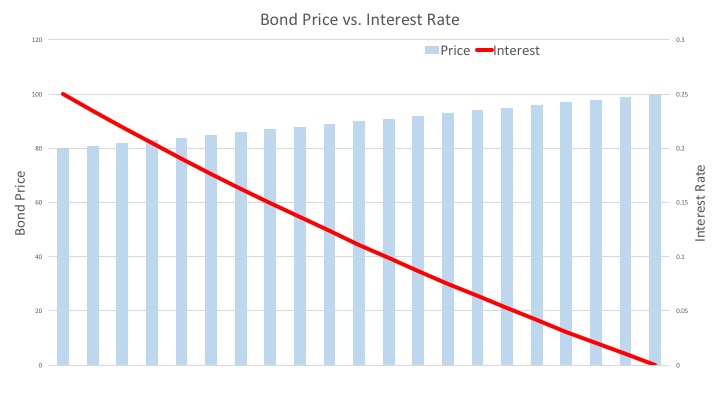

When the Fed buys bonds, their price goes up and the interest rate goes down. Think of it this way: if you buy a bond with a $100 redemption value for $80, the interest rate is 25%, but if that bond costs you $90, the interest rate would be about 11%. The more bonds the Fed buys, the more the price goes up, and the lower the yields become. Doing this on a massive scale impacts interest rates across the entire economy.

Now that you have a brief primer on how the Fed operates, let’s discuss why you should care. In essence, the Fed uses interest rates either to stimulate the economy during a downturn, or to slow the economy down to prevent inflation. For example, in the past few recessions of memory, you’ve probably heard of the Fed lowering the interest rates to near zero.

When the Fed sets a lower target for interest rates, the impact is that it becomes cheaper to make loans, allowing people and businesses easier access to capital that they, in theory, use to increase spending. The effect of this is to stimulate the economy. Meanwhile, if there is inflationary pressure causing prices to rise, the Fed can take action to raise interest rates, making borrowing more expensive and slowing spending.

When the Fed is lowering interest rates, it would typically mean that the economy is in need of a boost, and this generally occurs when there is an adverse economic event, like a recession. Lowering the interest rate is one way that the Fed operates to pull the economy out of a recession.

Impact on Stocks

What does this mean for the stock market? Several things. One, if the economy is in a recession, generally the stock market will decrease in value given the lesser outlook for commerce. With the economy not growing, people out of work, etc., the inclination is that people will spend less and companies will see reduced revenues and profit. However, the Fed lowering interest rates can often translate to an increase in the stock market given the prospect of spending returning in the future.

The Fed lowering interest rates does not automatically translate to higher stock prices. Remember, the economy may still be in a recession, so the two forces fight against each other, and often there will be some volatility in the market.

In addition to the state of the economy and the market value of companies that issue stock, there’s another factor at play when the Fed adjusts interest rates. As I’ve discussed elsewhere, stocks and bonds are natural complements to one another for investors who may choose a mix of them to balance their portfolios and risk. When the Fed lowers interest rates, it impacts the bond market by decreasing interest rates. The decrease in interest rates makes bonds less attractive to investors due to their lower relative return. So, looking for better returns, often you’ll see a flight to stocks, which sends their price up (greater demand = higher price).

Again, this is countered by the fact that the country may be in a recession. But, if you look at the past few recessions or bubble bursts, you typically see a steep drop in the market as the recession takes hold, followed by a steady increase thereafter. These effects not only bring the economy back to normal, but the market as well. This is why in the long-term, the market tends to trend upward, though not without volatility along the way.

The converse is true when the Fed raises interest rates. Typically the Fed will do this when it wants to slow spending. With only a set amount of dollars circulating in the economy, high spending leads to an increase in prices due to the fact that demand increases and the only way to counteract it is with higher prices (demand-pull inflation – look it up). To prevent inflation from taking off, the Fed increases the cost of borrowing by raising interest rates.

Now, when the Fed does this, it’s usually when the economy is booming. When the economy is booming, stock prices tend to be on the up and up given the fact that companies are doing well and their profits are solid – it’s just what happens in a good economy. But, as you might expect, an increase in interest rates can cause share prices to drop as investors look toward the future.

With interest rates increasing, the potential for growth is curtailed, reducing future prospects. And, as interest rates rise, bonds become more attractive, driving investors out of the stock market toward bonds, which lowers stock prices as investors sell shares. This effect is balanced out against the still-strong economy, which again results in volatility as the market goes up and down while the dueling forces compete.

For the FIRE Investor

To put it bluntly, the above is a very high-level overview of how the Fed’s actions impact the market in the short to medium term. For the FIRE investor, there are a few key takeaways.

First, short-term volatility is inevitable. As you probably see every time you log on to the internet, there are seemingly endless factors that can affect the economy and the stock market. The Fed is essentially there to help keep the economy from going off the rails, and yet, the actions it takes to do this can result in stock market volatility. So even the forces we have in place to reduce volatility in the economy as a whole can cause fluctuations in the stock market.

FIRE is generally a long-term investment strategy, meaning that investors need to keep their knee-jerk reactions under control when the stock market takes wild swings. Understanding that even the forces designed to balance out the economy cause stock market volatility should serve as a reminder that short-term volatility is just that; in the long-run, history has shown us that the market trends upward.

Second, whether you believe the Fed is responsible for it or not, the U.S. economy has walked a careful balance of growth since World War II. There have of course been recessions, and there have been periods of inflation, but by and large the economy has bounced back and grown along the way, showing a pattern of long-term stability. Long-term economic growth in part contributes to long-term gains in the stock market. Having an independent central bank like the Fed that keeps the economy in balance is at least one factor in the economic progress of this period, and it’s reasonable to believe that it will continue to do so, making a long-term investment strategy viable for retirement saving.

Third, the economy and the stock market are not the same thing, nor are they direct proxies of one another. If you need an example, look no further than 2020 when the coronavirus pandemic struck and the economy took a nose-dive as people lost their jobs and spending cratered. While the stock market initially jumped off the same cliff early in the year, it bounced back up and gained on the year, all while the recession persisted.

While the stock market and the economy as a whole undoubtedly bear some relation to one another, different forces act differently on both. And sometimes the stock market will react quicker. When the Fed announces it’ll adjust interest rates, the stock market tends to move immediately while the impact on the economy as a whole takes time to play out. The point is, when evaluating whether to invest in the market or how the actions of the Fed will be accounted for, consider the fact that various components of the economy move in different directions and at different rates. An economic downturn may not be a bad time to invest while an economic boom time might not be as good as you think.

Finally, the Fed cannot cure or control everything. The Fed is technically independent of the federal government even though its board is appointed by the president (appointee terms are staggered to prevent one administration from stacking the board). Whether the Fed is immune from political influence is another topic, though most Fed chairpersons have evidenced a fairly dedicated commitment to independence.

Nevertheless, even assuming independent control over the money supply, government actions play a significant role in the health of the economy, as well as how the stock market moves. You’ve probably noticed that political actions can send the market off into a frenzy regardless of other things happening in the economy. Moreover, there are certain times when the Fed’s power is curtailed. After the 2008 recession, interest rates hovered near 0 for an extended period, meaning the Fed had little power to influence the economy by lowering rates, at which point other factors can become more influential.

All of this is to say that the Fed is a powerful player in the U.S. economy, and its actions can significantly impact the way the market moves. Nonetheless, a long-term investment strategy that is properly balanced can benefit from the Fed’s role in the smoothing economic fluctuations. The same mantra as always must apply: don’t panic during short-term bouts of volatility, understand what you’re doing when you invest, and remember that history has shown us reasonable growth in the long-run.