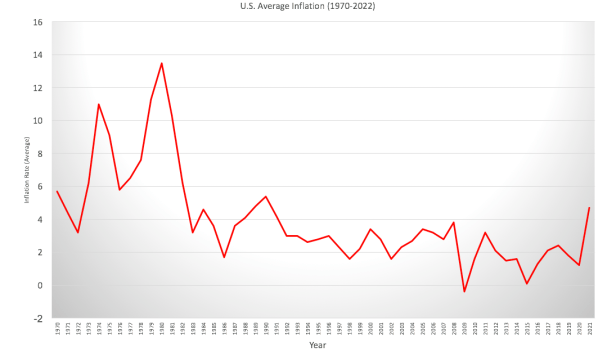

In prior posts, I’ve discussed how critical it is for a FIRE investor to consider inflation when calculating how much money is needed in retirement. In those posts, I used a relatively low inflation rate that was pretty consistent with the rate of inflation at the time. Since then, as you’re probably keenly aware, inflation has taken a different course, heading about as high as it’s been in the last forty years or so.

Given these higher inflation rates, the question is how they factor into the calculation of your future needs. Before getting into that, it’s important to note one important point: the rate of inflation years into the future is unpredictable. Since the 1980s, inflation has trended fairly low, and then following the 2008 recession, stayed about as low as it could for nearly 14 years. If someone had told you in the 1970s that inflation would remain as low as 1-2% for over a decade, they would’ve told you to stop siphoning so much gas from other people’s cars.

With overall inflation hovering in the range of 7-8% as of the time of this post, does that mean we can expect this to persist for the next 30 years? The answer is probably not, but with the caveat that we can’t exactly predict what the inflation rate will be when retiring.

It’s important to remember that one of the main functions of the Fed is controlling inflation by raising interest rates when inflation edges up. As of mid-2022, the Fed continues to take an aggressive approach to controlling inflation, including by taking the step of targeting an interest rate increase of 75 basis points in a single session, which it hadn’t done in some time. So as long as the Fed continues this approach, there should be some relief from higher inflation at some point down the road.

Another point to consider is that when the Fed raises interest rates, it tends to send the stock market down, as you’ve probably seen if you’ve watched your stocks app on the day of a Federal Reserve meeting. This is where it’s important to remember that you don’t actually lose money when the market value of your shares declines, unless of course you decide to sell. The buy and hold FIRE strategy is designed to withstand actions like this, and hopefully in ten years you’ll look back and see nothing more than a small blip in the market’s long-term upward trend.

Now, it’s all well and good to discuss the Fed’s approach to inflation, but the question is whether the higher inflation we’re seeing in 2022 will stay like this or be short-term. On the one hand, it’s good to see the Fed take an aggressive approach – as is its mission. On the other hand, it’s not entirely clear that the current bout of inflation is entirely attributable to economic happenings under the Fed’s control. Let’s discuss.

As I discussed in the post about inflation there are generally two types of inflation: demand driven and supply driven. The Fed’s control over inflation mainly pertains to demand-driven inflation – to the extent the Fed can increase prices by increasing interest rates, the quantity of goods and services demanded should fall, reducing price pressure.

Supply-side inflation, however, is different, particularly when it comes from a sudden shock to the economy. In 2022, take your pick of shocks, between COVID-related supply chain issues, the Russian attack on Ukraine, the fundamental shift in the US labor market, to droughts impacting food supply. These types of events are different, and the Fed lacks a magic wand to control them. These events fall at the whim of the larger governmental system and either require changes to governance or will have to work themselves out over time until there’s a new equilibrium. Tinkering with interest rates will only do so much to impact events of this magnitude.

So what does this all mean for the FIRE investor? As I started this post, it’s difficult to predict inflation, as it’s difficult to predict so many other things. If I had to guess, however, I’d say that it’s unlikely inflation will remain as high as it is in mid to late 2022. Between the Fed taking aggressive steps to raise interest rates and with the progression of time against the supply-side factors, inflation is likely to come down in the next few years.

Where and when it will land is anyone’s guess, but suffice it to say that I wouldn’t change my assumptions regarding future inflation to reflect a rate over 7%. I would, however, build in additional conservatism to my estimates of future needs. Given this, I might update my prediction of inflation to about 4.5% long-term, with the goal of revisiting the number in 2024 after the economy has had some time to stabilize.

If anything, we’ve witnessed that practically non-existent inflation was itself transitory, though it did last the better part of a decade. Inflation is still very much real, can be triggered by things we hadn’t even considered, and needs to be considered when looking toward the future.

So the question is – what to do about higher inflation. As soon as you plug in a higher number for inflation into your calculations, you immediately see that your anticipated spending increases and your available supply of money runs out earlier. The picture this paints is that you’ll either have to save more, retire later, or die earlier, none of which seem especially appealing.

The main thing to remember about inflation is that it doesn’t affect everything equally. Simply saying that inflation is 7.5% is not entirely correct, as it’s not as if the price of everything you buy just increases by 7.5%. Rather, inflation hits different products in different ways, and 7.5% is a calculation of how much the typical consumer’s overall spending increases over the period of time being measured.

What this means is that if you’re not buying some of the goods most impacted by inflation, you might not see the full impact. Unfortunately, inflation does tend to hit some of the most commonly purchased items like food, gas, and energy. There’s only so much you can do to get around these, meaning that increased inflation might force you to make some changes to your spending habits.

However, if we look at the bout of inflation measured in 2022, there are a few things that stand out; namely, cars, airfare, and rental housing. The easy (and stupid) conclusion would be to say to avoid buying these things, but that’s a copout. You may not own your house, or your car may be on its last legs, and what’s the point of retirement if you don’t travel.

The point is that, like everything with FIRE, there has to be balance and to get there you need to make trade-offs. With higher inflation, the trade-off becomes more evident. You may need to forego certain items, buy or lease a cheaper car, move to a smaller place, and travel differently. Alternatively, there may be other sacrifices you can make. Eating at home more often, traveling closer to home, etc.

Some of this might seem obvious: You’re telling me to save money I have to spend less…?! But the point is to underscore the importance of planning for FIRE. You’re attempting to live off money that won’t increase with additional wages, and doing so requires fitting your life within a certain budget. When one input changes (in this case inflation), so too must others respond (spending). Otherwise, you see that you can run out of money, and that’s, well, not how you do FIRE.

One final point I’ll make is about the stock market. If you research the topic, you might find articles saying that higher inflation translates to higher (nominal) returns on stocks. I’ve written about this before.

All I’ll say about this is that it’s not entirely clear, as you can see from the situation in 2022. Yes, inflation comes from spending, and spending generally means stocks go up; however, measures to tackle inflation like raising interest rates push stocks down. The market is forward looking, so when interest rates rise, investors start to price in a future decline. It’s difficult to predict how stocks will move, but I’d caution you against raising your anticipated rate of investment return to counter higher inflation rather than adjusting spend.

Anticipated rate of return is extremely fickle, to say the least, and that’s why the 6% rate of return I use addresses the numerous fluctuations experienced by the market. Remember, this is not the first time there’s been high[er] inflation in the U.S. The country has been through it before and the 6% rate of return accounts for these types of market behaviors. It would take a long period of sustained market returns less or greater than 6% to warrant an adjustment to this approximation and it’s too soon (for me at least) to make an adjustment just because of inflation. It might be worth revisiting in a few years, but I’ll stick with 6% for planning (for now)…