As I write this, in late 2022, the cryptocurrency market has witnessed an extended downward slide, with some cryptos losing approximately ⅔ of their value in less than a year. This isn’t the first time crypto has shown its volatility, however, and provided it continues to exist as a thing, it’s possible that it won’t be the last. Crypto tends to receive an inordinate amount of coverage for what it is; perhaps the futuristically enigmatic name gives it an intrigue that makes for good news fodder. Or perhaps it’s nothing more than the fact that nobody really knows what it is, what it’s good for, and whether it’s worth your investment dollars. So let’s break down what we know about it.

Unfortunately, cryptocurrency is one of those things that defies a simple explanation, but I’ll try to give one as basic as I can possibly conceive. Here we go: cryptocurrency is an electronically transferable unit capable of being assigned value. Basically, it’s an electronic piece of data that’s capable of being exchanged and will obtain the value that we assign it based on what we can exchange it for. It almost sounds like cash, which is a piece of paper to which we assign value; however, crypto exists electronically rather than as something we can touch.

Understandably, that definition won’t be enough for those who understand it on a higher level, yet at the same time is still too complex if you’re just trying to figure out what crypto even is. And I’ll admit that there’s far more to it than “currency,” and there’s a variation in the uses of different issuers of crypto. So let’s leave it at calling crypto an electronic, alternative method of currency. Still confused or dissatisfied? Well, that sounds about right.

Let’s talk about one other aspect of crypto that you tend to hear: blockchain. Blockchain is actually nothing more than an electronic ledger in which transactions are recorded. However, in theory blockchain assigns a unique identifier to each transaction, meaning that it should be an absolute method of proving ownership and provenance of the thing being recorded. Also in theory, it makes it secure from theft because you shouldn’t be able to replicate the transaction number and hence ownership. If you do some quick searching, you’ll see that this hasn’t played out exactly like the theory, but maybe you have an idea of the point.

Crypto’s link is that crypto transactions are recorded on the blockchain, theoretically making them secure. You may have seen people with digital keys to their crypto wallet and you may also have seen people who lost their keys and couldn’t access their crypto. The nature of the blockchain is that once you lose your transaction key, you shouldn’t be able to recover your crypto; this apparently has its pros and cons.

Ok, so now that some of the mystery is (potentially) resolved, what about crypto as an investment? And I think the short answer to that is: I have no idea!

Does that help at all? Let me give my reasoning and you can agree or disagree with me.

First, crypto is extremely volatile. This one you probably already knew if you ever see crypto mentioned on the news. Here’s a snapshot of Bitcoin’s price (and it’s here I’ll be admit – because I have to – that I own some Bitcoin):

Look at that movement. Up as high as $64,000, down to $16,000 a year later. Who would have ever thought it would scale so high or fall so far? Probably nobody, because, as I’ll discuss below, there’s really no way to predict what crypto will do. Suffice it to say, however, that crypto has shown extreme volatility since it came about, and if this is the case for the future, it’ll take an even stronger stomach than stock market movements.

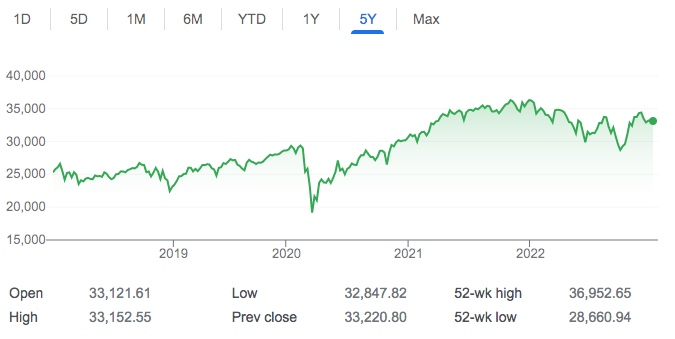

Second, crypto’s correlation with the stock market is unclear. If you look back a few years, at say the early days of crypto in the mid-2010s, there was a notion that crypto would move inversely to other investments; that is, it was truly an alternative. The stock market would go down, investors would flee to alternatives – including crypto – offering an option to blunt a downfall in the wider investment market. Or at least this was the theory.

Did this pan out? Well, not as of 2022. Take another look above at Bitcoin’s price and compare it to the Dow Jones over roughly the same period. Leaving aside that even the huge movement in the stock market looks tame compared to Bitcoin, I’m not seeing an inverse relationship. They both went up and down around the same time. So judge for yourself if crypto truly is an alternative to stocks.

Third, who knows exactly where it’ll go. With stocks, although we can’t say with certainty what will happen, we can reasonably conclude that stocks will rise in value over time and we have substantial history supporting this conclusion. We don’t have this with crypto. Now, you could easily argue that when stock trading first started, they too were speculative and nobody knew whether they would go up or down. And you’d be right, except that the entire investment landscape was completely different back then. It’s not like stocks just started trading 15 years ago – they became a thing when saving for retirement was not the long-term goal it is today. So it’s not really apples to apples.

The crypto markets simply lack the history to give us any way to value them down the road. I certainly can’t say that we can expect crypto’s value to increase by 6% over time. Any guess as to how they’ll move is pure speculation, which makes it difficult to plan how much you’d need to save and invest to reach a particular goal. It’s worth noting that stock market investment is not an exact science either, but at least we have some metrics available to help guide our decision making.

Fourth, there’s seemingly no intrinsic value. This is the tough one and this is where there’s likely to be disagreement. To explain this concept, it’s first necessary to consider what is meant by intrinsic value, particularly because seemingly no form of money has intrinsic value. Money only has value because we assign value to it – you can buy something for a certain amount of money because we value both things equally and we accept money because we know we can use it to acquire other things. (Let’s leave aside the fallacious concept of tying traditional currency to gold as a form of intrinsic value, given that the underlying gold itself has no intrinsic value).

Arguably stocks have actual value because in theory they entitle the holder to dividends and a portion of a company’s profits, meaning that their value is roughly tied to the financial standing of the company. This is where it gets difficult to describe crypto because crypto can seemingly take the form of either an alternative currency (to cash) or investment (to stocks). If you see crypto as a currency, then its value derives from what we can get for it – just like cash. Crypto could also arguably be an investment if you think it’ll rise in value.

But, as of writing, crypto is far less liquid than cash. You can’t spend it everywhere and in many cases you’d need to convert it to cash before you can actually exchange it for something. While there are some well-known exceptions to this (if you follow crypto news), it’s nevertheless difficult to describe crypto as a fungible form of currency.

Additionally, some cryptos have essentially unlimited supply – meaning that there is no limit on how much of it can be issued. I won’t get into the concept of scarcity creating value, which is a topic on which there’s plenty available with a little research, but let’s just say that this concept doesn’t apply to many of the available cryptos (not all of them – some do have limits). The translation is that your holdings can essentially be devalued as more and more crypto is issued, almost like a hyperinflation of your crypto. Although this can happen with cash, this generally doesn’t happen with stocks – even a stock split that creates more shares will not result in an immediate loss in value.

So the conclusion is that the value of crypto, at least as of writing, essentially exists because we say it does. It’s possible that we’ll continue to assign it value and it’s possible that we’ll no longer see any value in it – either way, the simple fact that it’s nearly impossible to predict should factor into your decision to hold it.

Finally, is it essentially the lottery? Well, maybe and maybe not. If you bought certain cryptos in 2017 and sold them in 2020, then you may have done pretty well for yourself. If you didn’t sell then or you didn’t buy until later or you haven’t bought yet, the lottery comparison starts to appear more fitting. Essentially you’re looking for something you bought to increase rapidly in value based on factors out of your control. You’ve probably heard stories of people spending a few thousand dollars on crypto before 2017 and the value increasing exponentially, ultimately minting some new million- and even billionaires. Kinda sounds like a lottery.

But I’d say that the lottery comparison is too harsh as of yet. Crypto needs more time to mature and to see if it’s truly viable for what we think it’s supposed to be. It could very well be that crypto is still in the growing pains phase as it seeks to gain mainstream acceptance, a significant component of which is people figuring out what it is, how to hold it, and how to use it. Only time will tell, but I’m sure we’ll be able to look back in a few years or even a decade and assess whether crypto was just a fad or if the 2010s and early 2020s were the start of something new.

We come to the conclusion for the FIRE investor, with the question being: is crypto a worthwhile investment to hold as part of a FIRE investor’s aggressive, yet balanced portfolio? And my answer is the same as I stated earlier: I don’t know, for all the reasons explained above. This is one where you’ll have to make your own assessment of the risk and decide whether it’s right for you. My assessment has led me to the conclusion that it’s very risky, particularly as traditional equity investing is likely sufficient.

I have no idea what crypto will do, where it will go, or whether it will be completely worthless, and I simply don’t have the risk tolerance to hold more than a small amount. I could be wrong or I could be right, but I do know that I try to base my investing decisions on data and numbers, and crypto simply lacks this information. But again, everyone is different and people achieve FIRE in different ways. Make an informed decision by understanding the risks, but make one that’s appropriate for you.