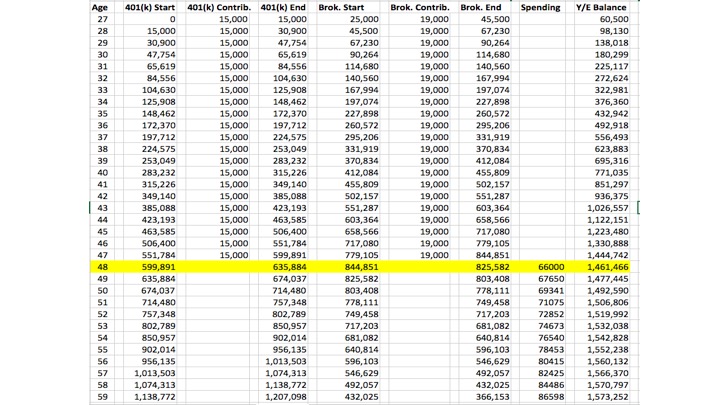

In a prior post, I gave a hypothetical scenario of savings and spending. In this post, I’ll do the same thing but with different assumptions, hopefully to show how tweaking the inputs can impact the outcome. In this example, I’ll assume that the FIRE investor starts saving a little younger, but with much less already saved. Let’s see what happens with the following assumptions.

1. Starting age = 27

2. Starting savings = $0 in a 401(k), $25,000 in a brokerage account

3. Yearly contributions = $19,000 to brokerage account, $15,000 to 401(k) including employer match

4. Annual rate of return = 6%

5. Annual inflation rate = 2.5%

6. Yearly Deductions = 0 until needed

7. Spending = $5,500 per month in retirement

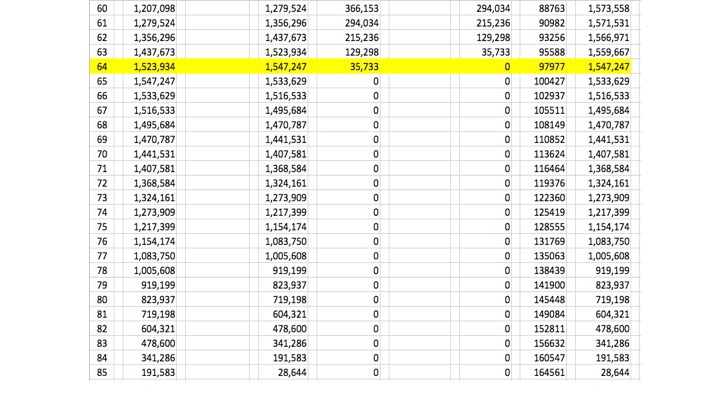

In this example, the FIRE investor retires at 48 with savings of $1,444,742 (the ending market value at age 47), and starts spending $66,000 per year. The brokerage account has sufficient funds to make it until age 64, meaning that the FIRE retiree does not need to dip into the 401(k) before 59 ½, avoiding early withdrawal penalties. At age 64, our retiree starts deducting from the 401(k) and makes it to age 85 before funds are too low to meet anticipated spending.

Compared to the first example, you can see that starting savings a little earlier and saving a little more can help build account balances quickly. Starting at 27 rather than 30 gives the FIRE investor three more years of benefiting from compound returns.

This example also shows what happens when you spend more during retirement, especially as inflation continues to increase the amount you need to spend to keep the same standard of living. While the FIRE saver who started at 27 was able to save more and retire at a younger age, the money runs out sooner than the FIRE saver who started later but spent less.

Naturally, there are different circumstances in both examples. The 30-year old saver started with more in a 401(k), and so on. Taken together, these two examples are worthwhile to show how different people in different situations might both end up with the ability to retire early, so long as they can make the numbers work. Obviously, different people will have different budgets for retirement and different goals for what they want to do.

I’ll offer more examples in future posts, showing how different rates of savings and spending impact the ability to achieve FIRE.